Swiggy is going public.

In this article, I try to take a deep qualitative dive and analyze Swiggy (and Zomato).

Comparison between Swiggy and Zomato

Revenue Growth & Profit Margins

Below is a summary of the revenues and operating profits of Swiggy and Zomato.

Two things stand out

Zomato has gone ahead of Swiggy in terms of revenues

Zomato’s revenues were 26% less than Swiggy’s in FY22.

By FY24, it had flipped to being 7.7% more than Swiggy.

In the first quarter of FY25, it is now 30% more than Swiggy!

For roughly the same amount of revenues, Zomato has much better profit margins

In FY24, Zomato made a slight profit of 43 cr while Swiggy lost 2350 cr. That’s a gap of around 21%.

In the latest quarter, Zomato managed a 177 cr profit while Swiggy lost 611 cr increasing the gap to 24.5%.

Business Segment

To drill deeper into the revenue and profit gaps between Swiggy and Zomato, I think it is useful to look at the different business segments.

We are all familiar with food delivery, grocery delivery and dining out segments.

What is interesting is the B2B segment which makes up the second highest source of revenues for both Swiggy and Zomato.

For Swiggy, this appears to be a subsidiary called Lynx which was acquired in 2023 and appears to be a supplier for kirana stores while for Zomato, it is a subsidiary called Hyperpure that Zomato acquired in 2018 and appears to provide food supplies for restaurants.

Both things appear extremely crucial for Swiggy and Zomato’s revenues and profits yet there is very little media attention focused on them nor is there much information on them either in their financial reports or on the Internet.

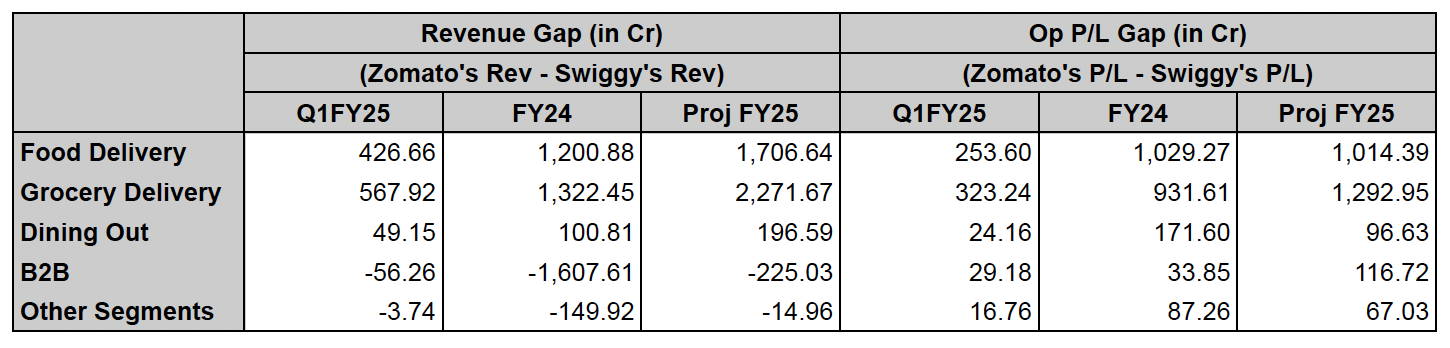

Drilling deeper, we compare the revenues and profits of Zomato and Swiggy by seeing the gap between the two across different segments

Proj FY25 is an extremely crude projection where I’ve just multiplied the Q1FY25 revenue and operating P/L of each segment by 4 to get an idea whether the gap increases (Zomato win) or decreases (Swiggy win) from FY24 to FY25.

Segment Revenues Comparison

We observe the following

Zomato makes more revenues in food delivery, grocery delivery and dining out segments while Swiggy makes more money in the B2B and other segments.

Zomato will increase the gap in revenue in food delivery, grocery delivery and dining out segments in FY25.

Zomato will get closer to revenues of Swiggy in B2B and other segments in FY25.

Segment Operating Profits Comparison

We observe the following

Zomato makes more profits (or lower losses) in all five segments, even in B2B and other segments where Swiggy makes more revenues.

In FY25, Zomato will increase the gap in profits in grocery delivery and B2B segments while Swiggy will decrease the gap in profits in dining out and other segment.

In FY25, the gap in profits should remaining roughly the same in food delivery.

It’s not looking good for Swiggy.

Misc Note

If you were paying close attention to the numbers, you probably noticed that the operating profits of all the segments together for both Swiggy and Zomato didn’t reconcile with the overall operating profits of Swiggy and Zomato.

That’s because they are some incomes and expenses that don’t fit into one segment or the other and so are separated out.

All these expenses have similar values except for other income. Other income is mainly sourced from from assets such as capital gains on mutual funds, coupon payments on bonds and interest paid on bank deposits.

Zomato has considerably more assets (around 15,447 cr tangible assets) compared to Swiggy (around 6,444 cr tangible assets) which means its able to generate more other income from its assets.

Since this income isn’t from core business operations (unlike say, share based payment expense), I’ll ignore this as this doesn’t really contribute much to the viability of the operations.

So why is Swiggy struggling?

So why is Zomato doing so much better than Swiggy? It can be easy to dismiss it as Zomato evidently has better operational efficiency but I think it’s worth it to try and speculate on the reasons why and whether they can change in the future.

We will focus on food & grocery delivery and B2B only as dining out and other segments do not have significant enough revenue to be a determining factor.

Food & Grocery Delivery

Two things are unmistakable. Zomato’s revenues in food & grocery delivery are growing faster than Swiggy and, in spite of that, Zomato is still managing to have better operational margins in both the segments.

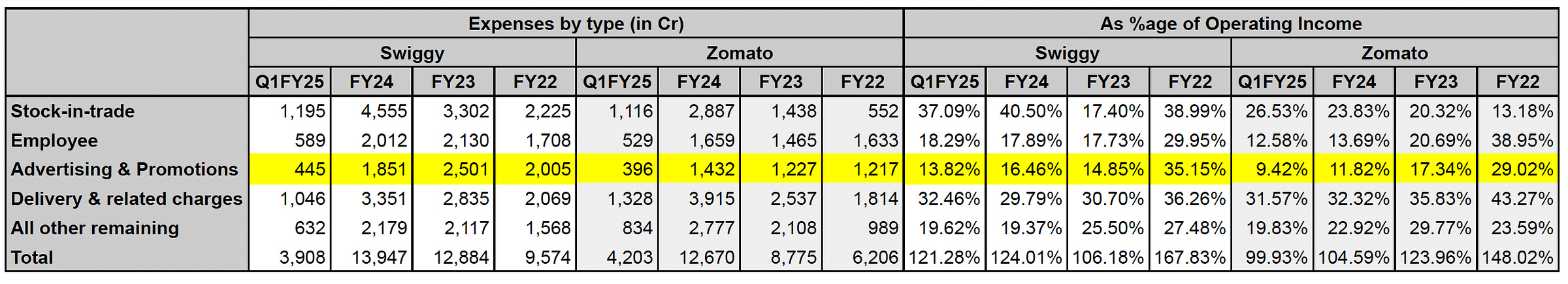

It’s useful to start with the different types of expenses Swiggy and Zomato have

We observe

Stock-in-trade is the grocery inventory that Swiggy and Zomato keep on hand to fulfil orders received on their grocery delivery platforms.

Swiggy seems to have higher stock-in-trade expenses which could indicate that they are a bit behind Zomato in building out their “dark stores” or could be Zomato is much more efficient, buying less excess stock-in-trade.

I don’t think this is something very defensible for Zomato as Swiggy will eventually build out their “dark stores” or become more efficient. Indeed, you can see signs of that happening as Q1FY25 numbers are almost identical (though you could argue Swiggy had considerably lower revenues for their grocery delivery segment compared to Zomato).

Swiggy has higher employee costs which could suggest that Zomato is more efficient.

However, looking at Q1FY25 expenses, Zomato seems to be catching up in employee costs.

Either way, I don’t think it is an insurmountable advantage as Swiggy can just cut staff to reduce their employee costs.

On delivery costs, there seems to be equity between Swiggy and Zomato.

The major insight, at least in my opinion is Zomato is far more efficient at advertising and sales promotions compared to Swiggy. I hypothesize that the main determinant for this is Zomato has much better organic traffic.

Therefore, Zomato doesn’t need to spend as much as Swiggy due to its position as a market leader in restaurant reviews and ratings.

This segment is a minor revenue source but adds a considerable number of average non-transacting users to their app that can be freely or cost-effectively converted into transacting users.

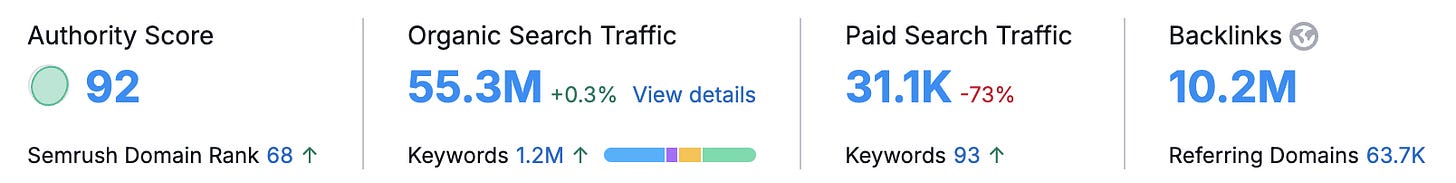

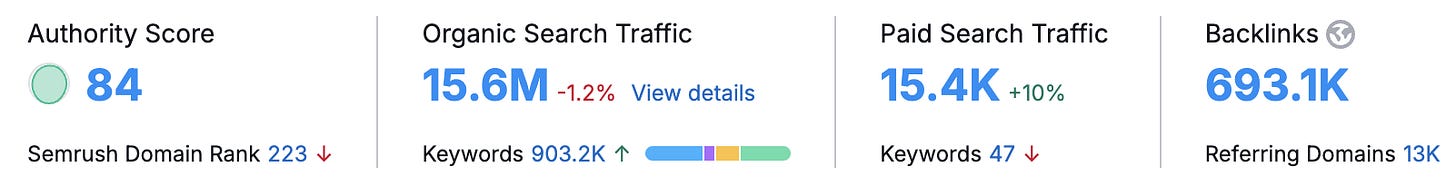

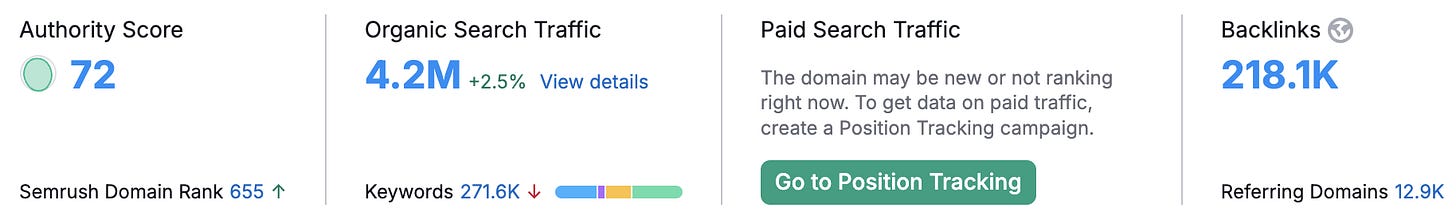

Below is an numerical analysis of Zomato, Swiggy and Dineout organic (and paid) traffic from search engines (Google). Data is from the SEO analysis tool, semrush.com

Zomato

Swiggy

Dineout

Zomato manages 55.3M visits which is more than Swiggy and Dineout combined (15.6+4.2=19.8M). This is mainly due the considerable amount of backlinks (10 times more than Swiggy and Dineout combined) it has accumulated as a restaurant review and rating source.

It’s not really going to be possibly for Swiggy to replicate this strategy so I don’t see Swiggy coming anywhere close to Zomato’s organic reach anytime soon.

So, should you invest in Swiggy?

As always, it all depends on the price.

Swiggy may not be profitable but all metrics show it going in the right direction with their eye-popping losses decreasing over time.

The food delivery (and grocery delivery) space is a duopoly now with Swiggy and Zomato having ~90% market share and we can see this in decreasing advertising & promotions costs for Swiggy.

Swiggy’s existing liquid assets minus its liabilities and its IPO proceeds give it a runaway of 4 years at current Q1FY25 losses of 611 cr.

So you have a company that trending towards profitability and is unlikely to run out of cash. It just may not be as profitable or big as Zomato but this could lead a scenario where the market discounts it severely which would provide a value buying opportunity.

Market Size

Swiggy included a report from a consultancy firm Redseer. I picked up two relevant tables from the report

The following conclusions can be derived about the online food delivery market from the above table

The online food delivery market size was 60,000 cr in 2023

Swiggy’s and Zomato’s food delivery GOV combined in FY24 is 56,941 cr which means online food delivery market is a duopoly.

They made 13,874 cr in combined revenues in the food delivery segment which is approx 25% of the GOV.

In 2028, the online food delivery market size is projected to be 1,40,000-1,70,000 cr. Let us take the conservative projection (1,40,000 cr) and assume that they capture 90% of this market and 25% of the this GOV goes into revenues which results in 31,500 cr of revenues for Swiggy and Zomato combined.

And yeah, China’s food delivery market size is insane. The biggest consumer market in the world.

The following conclusions can be derived about the online grocery delivery market from the above table

The online grocery delivery market size was 24,000 cr in 2023.

Swiggy’s and Zomato’s grocery delivery GOV combined is 20,537 cr which means, again, it’s a duopoly.

They made 3388 cr in combined revenues which is approx 15% of the GOV.

In 2028, the online grocery delivery market size is projected to be 2,32,000-4,240,000 cr. Let us take the conservative projection (2,32,000 cr) and assume that they capture 90% of this market and 15% of the this GOV goes into revenues which results in 31,320 cr of revenues for Swiggy and Zomato combined.

There’s also the dining out, B2B segment and other segments and I’ll assume they add roughly another 22,000 cr of revenues in FY28 taking the total to 84,820 cr of revenues for Swiggy and Zomato to divide amongst themselves.

Swiggy and Zomato Combined Growth Pathway

Below, I make a rough projection for the combined revenues of Swiggy and Zomato until FY28.

As mentioned above, I assume that Swiggy and Zomato will have 90% market share and project pathways to achieving this GOV in food & grocery segments.

As mentioned above, I assume 25% of GOV in food delivery segment contributes to revenues and 15% GOV in grocery delivery segment contributes to revenues.

For other segment, I fill in the expected growth rates to reach around the projected 84,820 cr of revenues.

Growth Scenarios for Swiggy and Zomato

Below, I make a rough projection for the individual revenues of Swiggy and Zomato until FY28.

The idea is that when Zomato has a high growth pathway, Swiggy would have a low growth pathway. Conversely, Swiggy having a high growth pathway would mean that Zomato has a low growth pathway. Finally, either of them having an avg growth pathway would mean the other does too.

I start off with using analyst consensus estimates for Zomato’s revenues of FY25 and FY26 and project the expected corresponding growth rates of Swiggy for FY25 and FY26. (Analyst consensus estimates are from Trendlyne.com)

For FY27 and FY28, no analyst estimates exist so I’ve just used the same growth rates across both companies for the scenarios.

The low + high growth combinations have slightly higher market sizes as assuming a high growth rate for either assumes a higher market size growth or higher market capture for the company that achieves high growth rate.

Based on these projections, in FY28 Zomato should have revenues of 30,252 cr, 48,903cr or 68,690 cr for the low, avg and high growth scenarios respectively while Swiggy should have revenues of 21,378 cr, 35,924 cr and 56,369 cr for the low, avg and high growth scenarios respectively.

These are all very crude and rough estimates and the goal here is more to gain an understanding of what is a good price to invest in for Zomato and Swiggy rather than making accurate projections.

Share Price Analysis

Below, I’ve explored the expected annualized returns (over the next ~3.5 years) one can expect at Zomato’s current share price (31st Oct) and Swiggy’s upper band IPO price.

We apply a range of profit margins from 20% to 5% to the projected FY28 revenues to get earnings and then calculate what the share price will be at different PE ratios.

I’ve chosen a range of PE ratios from 30 to 50 as both stocks should be in double digit growth rates in FY28 and the market usually considers such stocks as growth stocks and accords them a higher PE ratio than market average.

I’ll leave the conclusions to you but I’ll just note based on the analysis, Zomato feels overvalued and Swiggy’s Rs 390 upper band price feels more fairly valued (though it doesn’t appear to be undervalued).

For me personally, I feel like the most likely scenario for Swiggy is achieving 10% profit margins and the market valuing it at a PE ratio of 35 in FY28 so below, I’ve analyzed the expected annual returns for each growth scenario at different entry prices ranging from Rs 300 to Rs 380.

Again, I’ll leave the conclusions to you but I feel like if the share price of Swiggy drops below 340, it starts to look undervalued and hence, a good investment.

Therefore, I won’t be subscribing to the IPO but I’ll be watching the stock closely to see if it falls further after IPO.

Caveat - Zomato will be raising additional funds (around 10,000 cr) from QIPs so will result in dilution of outstanding shares and hence, above price analysis for Zomato would need to be updated after it.