ACME just went public a couple of weeks back and released their financial results today. We are also seeing NTPC Green go public this week.

So I thought it would be a good time to take a look at the solar power generation industry.

I will analyze the unit economics of the solar & other renewables power generation sector via a deep dive into ACME’s financials.

Unit Economics of Power Generation

ACME’s RHP includes a very comprehensive overview of the power generation business model under the Industry Overview segment.

Quick Overview

Solar power generation industry adheres to a “build-own-operate” model. Land for solar parks is set aside by the central or state government in partnership with an “offtaker” who invites bids from solar power park developers on the tariff to be provided.

The “offtaker” here is usually a central or state utility corporation that provides electricity to consumers or an intermediary such as SECI, NTPC. The Power Purchase Agreements (PPAs) between the solar park developer and “offtaker” are usually a fixed tariff over 25 years.

Average Power Purchase Cost (APPC)

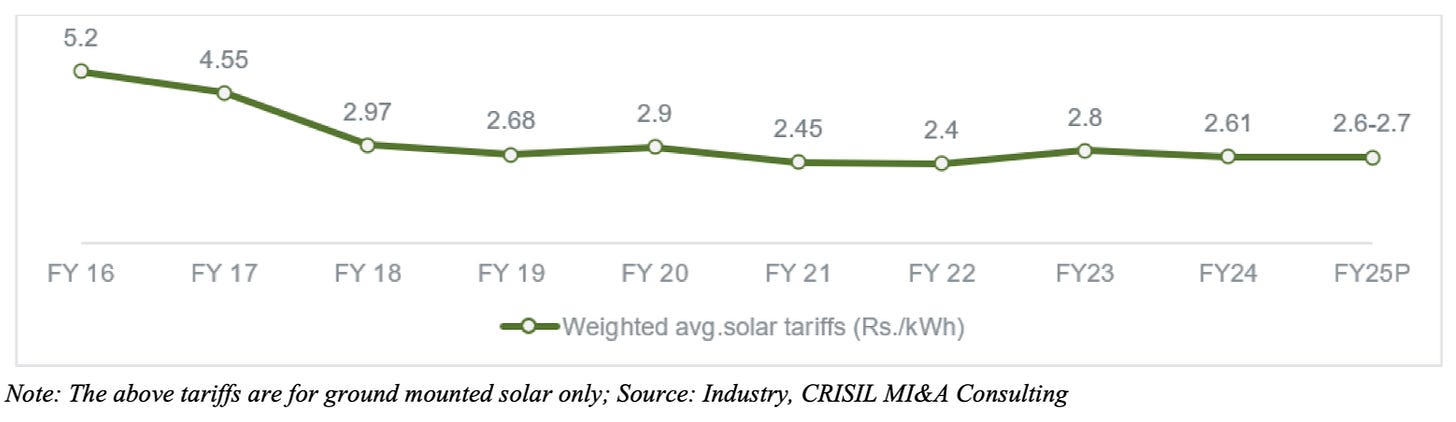

Below is a chart showing the evolution of the average winning bids in reverse auctions in ₹/kWh of power.

Below is a table showing the average power purchase cost (APPC) for non-renewable energy sources by central and state utilities.

I couldn’t find any sources for APPC after FY21 but I feel this data is sufficient to compare the purchase cost of renewable and non-renewable energy sources.

We see a trend of decreasing APPC for solar and increasing APPC for non-renewables with a flip happening in FY18 when the APPC of solar became cheaper than APPC of non-renewables.

If we assume that the APPC of non-renewables continues to increase at the current pace (i.e. 2.21% CAGR), the APPC of non-renewables should be 4.2 ₹/kWh in FY25.

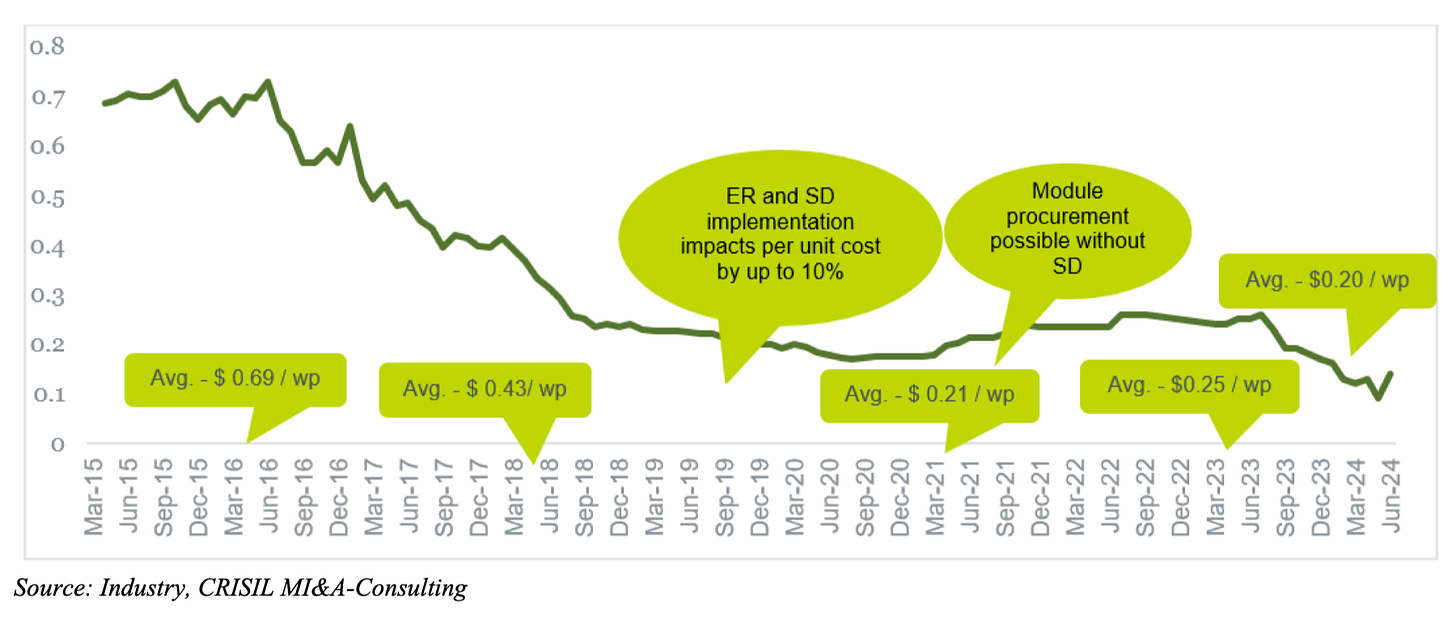

The drastic drop in APPC of solar is mainly due to the declining prices of solar modules over time. Below is a chart exhibiting the drastic decline since 2016.

While a lower power price has certainly boosted demand for solar power plants, solar power plants can generate electricity only during the day. Additionally, the weather conditions during the day need to be optimal.

This means that solar plants cannot adhere to a power demand schedule incorporating peak hours and seasonal demand patterns. Therefore, they aren’t directly comparable to non-renewables.

To negate this drawback, the industry appears to be establishing a preference for newer types of renewable energy power plants

Hybrid - The power plant includes wind turbines and since wind energy is available during the night as well, it has better power availability. However, the vagaries of nature mean that it still isn’t as reliable as non-renewables

Firm and dispatchable renewable energy (FDRE) - The power plant supplies as per the power demand of the utility making it equivalent to the non-renewable power plants. This is accomplished by using an energy storage system (batteries or small hydro pumps).

Below is a table showing the weighted average of successful bids in reverse auctions for these types of projects

There are two more types in the table listed in the table apart from Hybrid and FDRE, namely RTC and Peak Power supply.

It isn’t really clear from the RHP what exactly they and have they differ from FDRE but they are probably somewhat equivalent to FDRE.

We can see the hybrid power plants are still significantly below the estimated 4.2 ₹/kWh APPC of non-renewables, RTC power plants are at par whereas FDRE is slightly more expensive.

However, APPC of non-renewables are trending upwards while APPC of renewables are trending downwards. So we can expect that also to eventually flip in a few years time (it may have already happened, 4.2 ₹/kWh is just an estimate after all).

Additionally, while the national average is 4.2 ₹/kWh - there is considerable variation in APPC between states and the APPC of renewable energy projects may be attractive for some states while being unattractive to others.

Investments & Returns

Below is an interesting tidbit from the RHP on the returns solar power plant developers (SPPDs) target.

ACME’s RHP includes the project costs, equity contributions, interest/coupon rates, operations and maintenance costs and all other information required to individually calculate IRR for ACME’s solar power plants.

Below, I’ve calculated the project & equity XIRR for every one of ACME’s solar plants.

(Ignore the #NUM! ones, those are the ones which negative XIRR but Google Spreadsheet refuses to calculate these XIRRs for some reason and I’m too much of a spreadsheet noob to be able to figure out why).

I’ve defined the project & equity XIRRs as I’ve calculated below

Project XIRR - This is the annualized returns on the solar plant with the investment being the overall project cost. Negative cash flows are the initial project cost and annual operations and maintenance while positive cashflow are the tariffs charged.

Equity XIRR - This is the annualized returns on the solar plant with the investment being the equity contribution to the project cost. Negative cashflows are the initial project cost, annual operations and maintenance and annual interest paid while positive cashflow are the tariffs charged.

It is interesting to note that most of the solar power plants project XIRRs fall within the 12-14% IRR range mentioned above.

(Note: The RHP mentions equity IRR, not project IRR but I’m not really sure how they are defining it. I’ll assume they are referring to the return on the overall project costs rather than only the equity portion).

(Note 2: Equity XIRR is what investors i.e. you and me, can actually expect as they are not investing the full project cost, just the equity portion. )

For the debt portion, I’ve assumed (unrealistically) that these are 25Y corporate bonds with repayment of principal only upon maturity of the bond.

In the real world, these are mostly secured term loans (though ACME does have some “green bonds” traded in Singapore) and, thereby, need to be refinanced multiple times making them sensitive to interest rate changes and other macroeconomic conditions.

Therefore, the coupon/interest rate listed in the table will fluctuate over the 25Y life of the power purchasing agreement. Hence, the above table should not be taken literally.

The most obvious way to de-risk this factor is to increase the equity contribution by paying down debt using cash flows from selling power.

However, this means redirecting money away from new solar plants and hence, compromising growth.

ACME Financials Overview

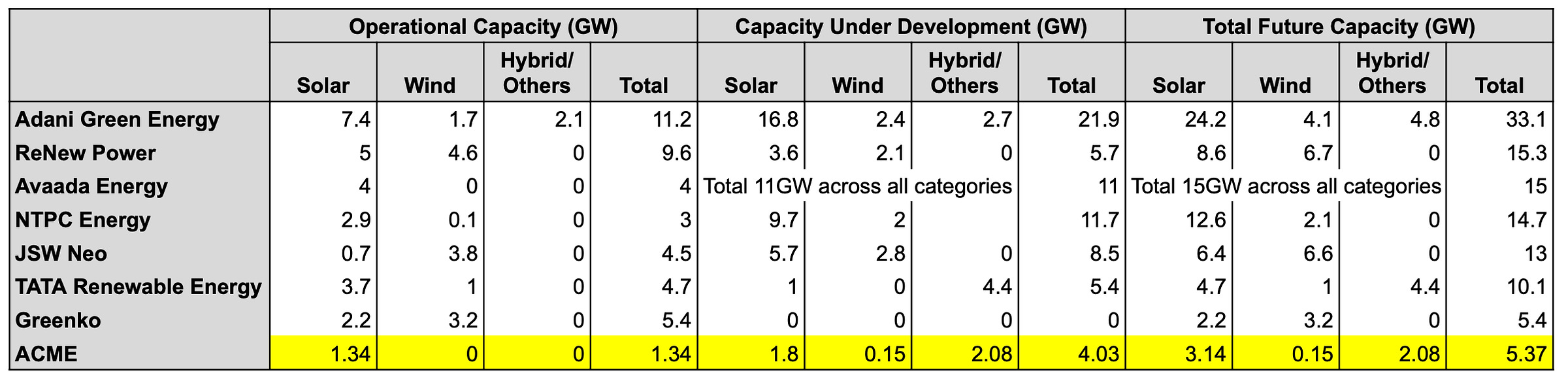

At the time of filing the RHP, ACME currently has 1.34 GW of installed solar capacity and is adding 4.03GW/4.98GW* over the next four FYs. This will increase their installed capacity by a factor of 5, so they seem to be aggressively expanding.

This is where I’ll focus since most of the value of the company will come from these future projects as their costs and revenues will greatly exceed the currently installed capacity.

* Depending on whether you count only projects where PPAs have been signed or you also include projects where Letters of Agreement (LOAs) have been signed, but no PPA yet.

Existing Revenues

Below is the list of installed solar plants.

We can estimate annual expected revenues of these solar plants from the capacity, tariff and capacity utilization factors.

The total revenues we estimate is 1,185 cr. The revenue from operations mentioned in ACME’s financials is 1,319 cr so the capacity utilization factors mentioned in the RHP are probably conservative.

Future Revenues

Below is the list of future renewables projects planned over the next four FYs.

I’d like to add the caveat that I’ve also included projects where only a Letter of Agreement (LOA) has been signed. I am not sure how many LOAs do not eventually lead to a Power Purchase Agreement (PPA) being signed so this might be an optimistic estimate.

The total future revenue estimate is 7,222 cr so by FY29, ACME should add at least 7,222 cr in revenues which is a huge jump when compared to their existing revenues of 1,319 cr.

Future Capital Expenses

Below are the capital expenses that will be required to build out these future projects

I’ve broken up the capex & equity portion contributions by FYs by using general time estimates provided in the project development mechanism mentioned in ACME’s RHP.

Based on the above flowchart, the equity contribution date is assumed to be the PPA signing date and the procurement date is assumed to be approx 15 months from PPA signing date.

Below, I’ve compiled the estimated revenues, equity contributions and total capex by by FY.

Possible Cash Shortfall

Based on the above table 4,885 cr of cash will need to be sourced for the equity contributions over the next two FYs. (3,557 cr in remainder of FY25, 1,328 cr in FY26)

Below is a table of ACME’s assets available to be used for the equity contributions as of the end of Q1FY25.

To me, it looks like there is 1,743 cr of cash shortfall between the estimated equity contributions and the estimated cash reserves.

It will be interesting to see where they source the capital for equity contributions from. Some possible sources

They use the proceeds earmarked for debt repayment in their RHP.

They raise additional capital from equity next year which would lead to dilution of existing investors.

They sell some of their existing solar plants. In fact, it looks like they already sold off some of their existing solar plants for 1,149 cr.

Valuation

There are a couple of ways of thinking how to value a solar power generation company

Relative Valuation

Comparison with Renewables

Below are all the competitors of ACME Solar listed in the RHP along with their operational & under development renewable energy capabilities.

Renewable power generation projects all have similar returns and there is no moat that results in higher margins or lowest development costs.

Therefore, I will make a gross simplification and compare the operational, under development and total future capacity.

Only two of them are publicly traded - Adani Green Energy and ReNew Power (listed on NASDAQ, not BSE/NSE). Below is the comparison

We observe the following

Adani Green seems overvalued relative to ACME - Adani Green has 9.8x times the market cap of ACME but 8.4x times the operational solar capacity of ACME and after the rest of the solar capacity is developed, will have 6.2x times the operational solar capacity of ACME

ReNew seems undervalued relative to ACME - ReNew Power has 1.2x times the market cap of ACME despite having 7.2x times the operational solar capacity of ACME. This proportion falls to 2.8x after the rest of ACME’s and ReNew solar capacity is developed.

Intuitively, it may feel like Adani Green Energy is overvalued while ACME & ReNew Power is undervalued. However, since these comparisons are relative, all three could be overvalued or undervalued or some other combination of overvalued and undervalued.

ReNew Power also does not seem to be ramping up growth as fast as Adani or ACME so the market could be adjusting for slower growth of ReNew Power over the next few years, which is why it is the most undervalued relatively.

Comparison with Non-Renewables/Mixed

Another way we could analyze whether solar power generation companies are over or undervalued is to see the compare in terms of PE ratios with traditional power generation companies (hydro, thermal, even nuclear).

However, the later are mature businesses with no new projects except renewables while the former are in their growth stage launching several new projects every year.

Below, I’ve compared the debt to equity ratios of solar power generation companies and traditional power generation companies.

Considering that solar capacity expansion is likely to take place on an aggressive level over a decade, I don’t think there is much insight to be gained when coming to traditional power companies.

Intrinsic

Below is a table where I’ve calculated the intrinsic value of each existing, under construction and upcoming solar plant using the discounted cash flow (DCF) model.

I’m no expert at financial modeling so I’ll list out the steps (and hopefully, they are correct!)

I assume the terminal value of the project is 0 after the PPA ends.

I assume that the cash flows are over the remaining years of the project.

I assume that the cash flow for each year is the estimated revenue adjusted for an annual degradation factor of 0.5% and less the operations and maintenance costs.

I assume that the discount factor is the weighted average cost of capital

Cost of equity is assumed to be 14.20% as per the NSE-E&Y 2024 Cost of Capital survey [1]

Cost of debt is assumed to be 9.40% which is the interest rate of the most recent loan mentioned in ACME’s RHP.

Market value of debt is calculated using bond pricing model with Yield to Maturity taken as 9.40%

Market value of equity is calculated on the prorated basis based on the estimated revenue of the project, total estimated revenues of all the projects and the market cap of ACME Solar Holdings (as on 22 Nov 2024).

I assume the effective corporate tax is 31.2%

To get the value of the project, we subtract the balance remaining of the loans from the Present Value (PV) of all the FCFFs

We get a valuation of 21,331 cr which is indicates that the stock is 43% undervalued as on 22 Nov 2024 (market cap was 14,878)

However, valuations are not an exact science and there are many assumptions.

Assumption of cash flows - While there should not be much variation in cash flows with clearly defined tariff rates in PPA, there could be variation in

Timing of cash flows - Projects can get delayed which would push revenues from the project further back leading to a larger discounting factor i.e. the future cash flows would be worth less.

Sale of projects - As mentioned above, additional funds may need to be raised by selling existing plants which would reduce cash flows in the near future which would be significant as these cash flows are discounted the least.

Assumption of discount factors - Intrinsic valuations are very sensitive to the discount factor used. Here, two things mainly constitute the discount factor

Cost of equity - Here, I assume it to be 14.2% based on the survey by NSE & E&Y [1] but the solar industry is a young industry and, therefore, investors might expect a much higher return to compensate for risk, leading to a higher cost of equity for solar firms.

Cost of debt - Here, I assume it to be 9.4% based on the interest rate of their latest term loans but those were in March 2023 and it is unclear what kind of interest rates solar firms or ACME specifically could command today.

(Update from today’s investor presentation - they announced that they managed to refinance 2,116 cr of existing loans at 8.8%-8.9%)

Others

Dilution of shareholding - As mentioned above, additional funds may need to be raised from the equity market in order to meet the equity portions of the capex which would lead to dilution of shareholding and the current market price might reflect this anticipated dilution.

Below is a table compiling the valuation using DCF method for different combinations of cost of debt and cost of equity

ACME looks overvalued only when the cost of debt of 11.5% and cost of equity greater than 15%.

Below is a table compiling the diluted share price assuming the firm raises a round of equity funding. The columns are the amount raised in Cr while the rows are the offered share price to investors in the presumed equity raise.

Even after dilution, ACME current share price looks like it is undervalued.

I think this is probably a good spot to add the standard “not financial advice” disclaimer.

The information provided is for research purposes only. I am not registered with the Securities and Exchange Board of India (SEBI) as a financial advisor or investment advisor.Valuation of NTPC

Part 2 of this will is where I’ll be taking a look at the fiances of NTPC and valuing it. Subscribe if you’d like to get an email when it’s out!

Notes

Tables

You can see the source spreadsheets for all the tables above on the shared Google spreadsheets below. If I’ve made any errors, I would be grateful if you let me know either by Substack DM or in the comments below.

https://docs.google.com/spreadsheets/d/1Gqu_pXDFkj95gxdJto6K3GcwXAFCrc3hRpevjknBFYQ/edit?usp=sharing (XIRR calculations)

https://docs.google.com/spreadsheets/d/1CJZEzITw6HLkPlAtFoX85mytHssduhdMvBWLVqv9Kfg/edit?usp=sharing (All other tables)